News

How to survive the data apocalypse

By Nick Young, Director of Sales – Digital at Nine

Third-party cookies have been the backbone of the digital advertising industry for the last 20 years, so when Google announced Chrome would phase out support for third-party cookies within two years, following earlier moves by Safari and Firefox to do the same, marketers were understandably concerned. After all, collectively, these browsers account for almost 90% of global web traffic.

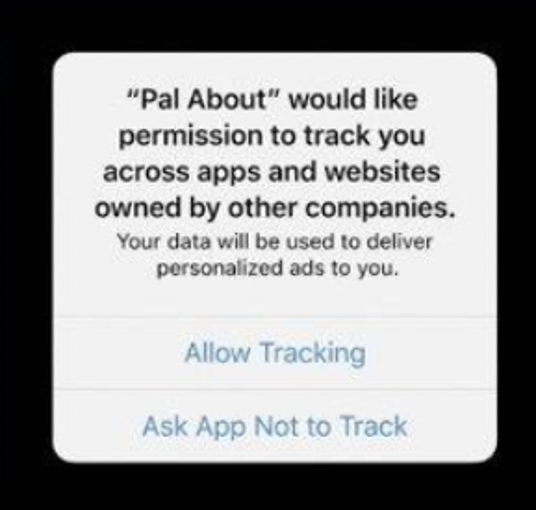

Apple is now set to follow suit with iOS14 to force app publishers to obtain opt-in consent from users to collect their IDFA – an identifier that is unique to each Apple device, used to target and measure audiences across apps. It’s expected that 80-90% of users will opt-out, substantially reducing coverage of the IDFA across app audiences on Apple devices.

So, what impact will this have?

For marketers, they’re unlikely to see major changes to how they plan and buy social media since Facebook’s audience is signed in and can still be tracked. They’re also unlikely to see many changes to how they plan and buy search.

The big changes will be in the use of display and video within the media mix – particularly programmatically. Many marketers today use data collected from their websites, apps and third-party data collected from data aggregators to remarket to and target audiences across websites and apps. These data sets reside in the marketer’s Demand Side Platform (DSP) as audience segments comprised of third-party cookie data or IDFAs. Even cookie data collected from an advertiser’s websites becomes third-party cookie data when activated across exchanges on other websites.

Not even Facebook is immune to tracking on other websites. Earlier in the year, it announced its plans to shut down components of its audience network because it will have difficulty identifying audiences that have been on Facebook when they resurface on other websites not owned by Facebook.

For publishers, the impact will be different. It’s important to clarify that the changes from Google and Apple are not intended to limit publishers’ ability to track audiences within their websites and apps. Safari, Firefox and Chrome will only block third-party cookie tracking. First-party cookies – where publishers set cookies on their websites – will continue to be supported. This will allow publishers to continue to build granular audience segments from interactions across their websites.

Similarly, Apple’s changes in iOS14 are not designed to prevent app publishers from tracking audiences within their apps – it is intended to force publishers to gain opt-in consent from a user if they wish to track them across their app AND other companies’ apps and websites, as clearly stated in Apple’s opt-in message:

Now that we understand the expected impact, how can we adapt to these upcoming changes to ensure our digital marketing activity continues to be effective?

If you’re a marketer, start putting plans in place to wean yourself off reliance on third-party cookies and mobile device ID data. We recommend focusing your efforts in two areas:

1. Develop your first-party data asset built off identity, and implement systems to support activation of “people-based” data.

2. Partner more closely with publishers to leverage their first-party data which will be resilient to these approaching changes.

People-based data is built on consumer identity, such as a unique and persistent identifier from a consumer login. Identity data will become the new data currency in the industry when support for third-party cookies is phased out and the IDFA becomes scarce. Without the ability to identify a consumer when they interact with your brand by having them sign in, it will be increasingly difficult to track their interactions and personalise marketing communications to them across the open web and app environments.

Where possible, work on ways to develop first-party people-based data assets. Look at ways in which you can create a value exchange with your customers to encourage them to create an online account and sign in. This will also enable you to tie together online and offline data on your customers.

Collecting data is only one piece of the puzzle. To enable the insights, activation and measurement of people-based data, you will likely need to review your marketing technology stack and implement new systems designed for managing customer data.

Several customer data platforms have now entered the Australian market. They are powerful platforms that provide these capabilities, and it is worth exploring how they can support your needs for people-based data now and into the future.

At Nine, we have been laser-focused on unifying data from our vast portfolio of properties and consolidating the user IDs across our publications. Today we have more than 13 million identifiable users across Nine’s assets and growing.

Our recently announced world-first partnership with Adobe allows advertisers to activate first-party people-based data without reliance on cookies or device IDs. Marketers can now match the hashed email addresses of customers to Nine’s signed in audience to target campaigns across 9Now, including on connected TVs where cookies and device IDs don’t exist.

Over the next six months, we will further invest in this Audience Match Product and expand it across the entire Nine digital network because we firmly believe that it will be critical for marketers to partner more closely with us and other media businesses to leverage publisher data in a cookie-less world.

Data that has traditionally resided in DSPs is becoming less effective but targeting can still be achieved by leveraging publisher first-party data through programmatic deals with publishers.

Moving forward, for advertisers, the focus must be on forming strategic partnerships with publishers who sit on troves of first-party data. These relationships will be elevated above traditional transactional media where the sharing and activation of data between both parties creates substantial business value, driving customer insights and improved return on investment for brands.

As the industry continues to evolve, premium publishers are well placed to serve the needs of advertisers through the unique view we have of Australian consumers – and our ability to reach them in a brand-safe, privacy-compliant environment. These environments are fuelled by professionally produced and curated content that feeds the entire purchase funnel.

If you’re an advertiser reading the headlines about the cookie-apocalypse and becoming increasingly concerned about how to survive it, first-party data and partnerships with publishers will be your absolute best bet.